U.K Autumn Budget 2024 – Developments for the Energy Sector.

Following their election victory in July, the first Labour budget in fourteen years was presented on 30th October.

Amidst the usual Commons rowdiness, Chancellor Reeves delivered a lengthy speech, bouncing from National Insurance to the NHS to “a penny off a pint”. Here at Equity Energies, we’ll stick to what we know, and rattle through the highlights for the energy sector.

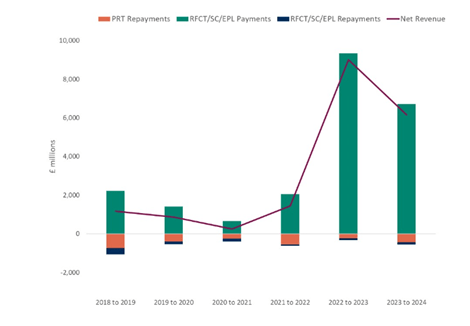

The Energy Profits Levy will be increased from 35% to 38%, with the scheme extended until March 2030. Introduced in May 2022, the EPL is a windfall tax on oil and gas companies. Labour have also scrapped the 29% investment allowance, a mechanism allowing companies to offset tax from re-invested capital, but, by maintaining such incentives such as first year capital allowances and decarbonisation allowances, have softened the impact of the rising windfall tax rate. In fact, share prices for some North Sea producers rose in the aftermath of Reeves’ speech, indicating the measures were less severe than anticipated. The expectation is that Labour will look to use increased EPL revenues to fund energy transition projects, but with fossil fuels required for years to come, convincing producers of their long-term role will be crucial.

UK Government oil and gas tax revenues

Source: https://www.gov.uk/government/statistics/government-revenues-from-uk-oil-and-gas-production–2/government-revenues-from-oil-and-gas-production-september-2024

In terms of those energy transition projects, there were a few snippets that caught our eye. Investment in electric vehicles is set to increase, with over £200m in 2025-26 assigned to improving the charging network, and company tax incentives to purchase electric cars to remain in place. The rate of vehicle excise duty is due to be increased for non-electric vehicles from April 2025, in a measure projected to raise £400m, while simultaneously making EVs more attractive.

Labour’s election manifesto focused their nuclear ambitions on completing Hinkley Point C and increasing the role of small modular reactors (SMRs). There’s little mention of these targets in the budget, except for a note that Great British Nuclear’s SMR competition is ongoing, with final decisions regarding vendors to come in the spring. Elsewhere, £2.7bn has been earmarked for the continued funding of Sizewell C’s development over 2025-26.

Other developments include 11 new green hydrogen projects, and £3.9bn of funding in 2025-26 towards carbon capture, usage and storage. As noted by my colleague Natalie Oliynyk in our regular “End of Day Market Report”, this is part of the government’s previously announced £22bn pledge to fund carbon capture projects. As comparatively new areas of the green transition, there lies considerable potential for job creation, with an estimated 4000 new jobs across Merseyside and Teeside highlighted by Reeves.

OBR forecasts are calling for GDP growth of 1.1% in 2024, with yearly growth ranging between 1% and 2% yearly until 2029. Hitting net zero targets while taming the cost of living crisis, controlling government debt and achieving growth will prove difficult, but the rhetoric from Labour appears to be committed to following through on green election promises. The Energy Security and Net Zero department’s expenditure limit is due to rise at a faster rate than any other, testament to the government’s drive to invest in the sector.

Total Departmental Expenditure Limits (excluding depreciation)

Source: HM Treasury Public Spending statistics, HM Treasury DEL Plans, and Office for Budget Responsibility

If you would like to talk more about market developments, particularly within the context of your business, our energy experts are on hand to help. You can contact our risk and trading team by emailing trading@equityenergies.com.

Sami Siddiqui

Trading Analyst, Equity Energies

Sources

https://www.gov.uk/government/publications/autumn-budget-2024