Early Energy Developments from the New Trump Era

We’ve prepared a rundown of the key developments from the change in government to the new Trump administration, and how they could affect global energy prices and the transition towards Net Zero.

“Drill, baby, drill”

If you’re short on time, those three words capture the new Trump administration’s approach to climate and energy. For those of you wanting some more substance, we’ve prepared a rundown of the key developments from the change in government, and how they could affect global energy prices and the transition towards Net Zero.

What already happened?

The early headline-grabber may be Trump signing off on a (second) withdrawal from the Paris Agreement, after doing so previously in his first term. The Biden administration subsequently re-entered the agreement; this latest development marks eight years of uncertain direction from a country many look to as a global leader.

There are warning signs that this second withdrawal will be more damaging than the first. Aside from the increased urgency to address climate change eight years on, this withdrawal will only take a year to enact, as opposed to the three and a half year exit in Trump’s first term. This could cost developing countries up to $11 bn in U.S climate funding, and leave a sizeable hole in the budget for the U.N climate secretariat.

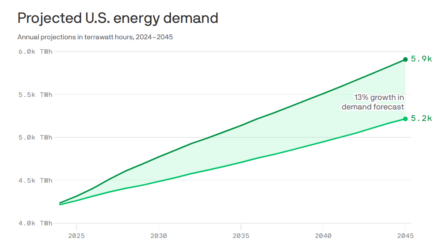

Trump has also declared a “national energy emergency”, opening the door for swifter turnarounds of permits for new fossil fuel projects, to cope with a forecasted rise in domestic demand during the data centre boom.

Source: Data: ICF, Chart: Axios Visuals

While a pledge to “unleash Alaska’s resource potential” may require a longer, more challenging, timescale to enact, the immediate reversal of Biden’s pause on permits for new LNG (Liquified Natural Gas) projects could be a quick win for the new government. As the world’s biggest exporter of LNG, this is an established sphere of American dominance that Trump will be keen to unleash to its fullest potential.

Doubling down on the fossil fuel play, Trump has ordered an end to Biden’s Green New Deal, a series of proposals designed to achieve 100% renewable electricity by 2030 and full decarbonisation by 2050. In a similar vein, mandates for electric vehicles and leasing of offshore wind farms have also been revoked, painting a stark picture of the fossil-fuelled America to come.

What could be next?

The word on every economist’s lips is “tariffs”, a popular buzzword on the campaign trail. Notably, Trump promised to slap a 60% tariff on imported Chinese goods, and took aim at other trade partners such as Mexico, Canada and the EU. As of his second day, that rhetoric has eased to a potential 10% tariff for China, potentially from 1 February, with no confirmed actions yet for other blocs.

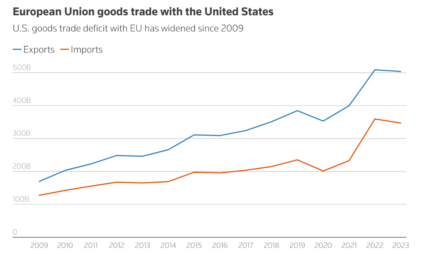

For the EU, a trade war could involve U.S wielding their oil and gas influence, to the detriment of the European buyer. Trump is keen to address the consistent trade deficit for goods with the EU, and could implement tariffs on European imports, such as cars and machinery, to rectify the imbalance.

Source: Eurostat, via Reuters News

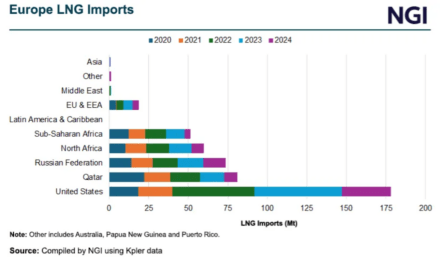

He has also said that Europe should import more American oil and gas, although details are currently sparse. Should the “drill, baby, drill” tactic come to fruition on the domestic scene, and Europe continue to rely on American fuel, particularly LNG, there could be scope for price hikes in the future. However, given the stronger rhetoric around the other potential trade wars, such effects on Europe may remain hypothetical for a while.

How could this affect the markets?

As with any major global change, increased volatility is to be expected for the energy markets as the Trump Effect unfolds. However, for European gas prices, the tangible effect of these new policies may take months, if not years, to appear, as LNG facilities are developed. On 22 January, the CEO of Uniper said the new U.S strategy would “reduce the world gas price” by supplying Europe with more energy. Given Trump’s insistence on using tariffs and trade advantages to strengthen the U.S economy, don’t be surprised if this extra supply comes at a cost, particularly if Europe continues to rely on U.S LNG.

Source: NGI, data from Kpler

It’s therefore important that Europe continues to develop its own energy infrastructure, to ensure a degree of price control. The Equity Energies trading desk will monitor Trump’s actions as a long-term market driver, and continue to report on events in our daily market intelligence to bring best value to our clients.

Ready to explore how these early Trump-era energy shifts impact your projects? Contact us today to connect with our expert team.

Sami Siddiqui, Trading Analyst

Trading Analyst, Equity Energies