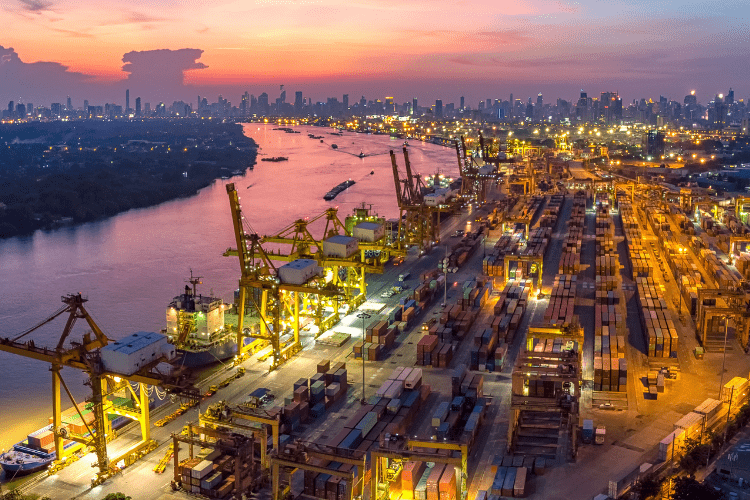

Comprehensive energy portfolio management solutions

Streamline, optimise, and strategically manage your energy portfolio to reduce costs, mitigate risks, and meet sustainability goals.

Who needs energy portfolio mangement?

Perfect for multi-site organisations, energy-intensive businesses, and procurement managers seeking to centralise control, simplify complexity, and improve sustainability outcomes.

Centralised control and visibility

Gain comprehensive oversight of your entire energy portfolio through our centralised management services. We provide complete visibility, enabling better decision-making and enhanced operational control.

Risk mitigation and strategic planning

Our expert energy portfolio management solution minimises risk through proactive strategies and market intelligence. We protect you from price volatility and regulatory changes, securing long-term cost stability and predictability.

Drive sustainability and compliance

Our services can align your energy strategy with sustainability targets, regulatory compliance, and corporate responsibility goals, significantly enhancing your environmental credentials.

Talk to our Client Services Team today

Portfolio Management – turn energy complexity into clarity

Managing a diverse energy estate should not drain time or margin. Our Portfolio Management service brings every contract, meter and tariff into one transparent view, so you can focus on driving performance, not chasing data. From half-hourly electricity to multisite gas, water and on-site generation, we aggregate it all inside our Unified Platform. With automated data feeds and AI-powered validation, you see the full picture in seconds, not weeks.

Is Portfolio Management right for my organisation?

If you operate more than one supply point, the answer is yes. Fragmented bills, ad-hoc renewals and reactive buying all push costs up and resilience down. We synchronise procurement cycles, align end dates and benchmark each site against wholesale curves and non-commodity charges. This joined-up view unlocks bulk-buying power, reveals hidden energy waste and gives finance teams rock-solid cost projections.

See the risks before they hit the bottom line

Commodity prices can move dramatically in a single quarter. That volatility needn’t derail budgets. Our trading desk tracks live power and gas markets, using value-at-risk modelling to flag when exposure creeps outside your tolerance bands. We lock volumes at strategic lows, layer flexible trades where headroom exists and hedge network costs ahead of tariff reviews, protecting you from surprises while capturing savings.

One portfolio, one pathway to Net Zero

Energy strategy and sustainability should never compete for attention—they accelerate each other. We overlay carbon factors onto every kilowatt-hour, highlighting hotspots and simulating the impact of renewable PPAs, sleeved contracts or efficiency projects on both emissions and spend. With clear dashboards, you can vet each initiative against your Science-Based Target and choose the measures that deliver the greatest CO₂ abatement per pound invested.

Simple reporting, real conversations

Our monthly digest turns terabytes of interval data into the metrics your stakeholders understand: £/MWh, tCO₂e and variance to budget. You also get invoice validation, accrual forecasts and board-ready commentary, all available 24/7 through the Unified Platform. When questions arise, your dedicated analyst is one call away—because technology works best when experts are ready to translate insight into action.

Future-proof decisions with continuous, real-world insight

Regulation, network charges and weather fundamentals evolve daily. Our market-intelligence team monitors policy shifts and grid changes round-the-clock, feeding scenario analysis straight into your dashboard. Quarterly strategy reviews convert that intelligence into actionable recommendations—whether renegotiating a clause before indexation changes or reallocating budgets to capitalise on dipping certificate markets. You stay ahead while competitors react.

Why choose Equity Energies?

For more than two decades we have empowered organisations to advance on their pathway to Net Zero and beyond. Clients stay because we pair a proprietary digital toolkit with FCA-accredited governance, supplier-agnostic advice and transparent fees. Add seasoned traders, data scientists and sustainability strategists, and you have a partner that turns energy complexity into commercial advantage.

Advance on your pathway to Net Zero and beyond – book a call with our Portfolio team today and start saving right now. Equity Energies